The FPM ASBL, represented by its General Manager, Mr. Jean-Claude THETIKA has officially launched, March 24, 2023 in Kinshasa the Financial and Digital Education Program (PEFD) in partnership with VISA, represented by Mrs. Sophie Kafuti, Country Director for the DR Congo. This program is a continuation of the National Financial Education Program (PNEF) set up in 2016 by the Central Bank of Congo (BCC) with the technical and financial support of GIZ, and for which the FPM ASBL has been an important partner in the implementation of activities. This financial and digital education program, will be implemented over a period of 3 years and has the following objectives: – Provide the Congolese population with the necessary knowledge, skills and confidence in order to optimally manage its finances. – To optimize the use of existing payment methods on the market. – To support the increase of financial inclusion in the DRC. The awareness and implementation of the financial education program will be done in 10 provinces of the DRC through 3 axes: – The implementation of a multimedia campaign – The organization of Training of Trainers and multipliers – The organization of financial education forums. VISA is an international payment technology company that enables consumers, businesses, banks and governments to use digital payments. As a trusted network, VISA facilitates digital payments in more than 200 countries and territories among a global array of consumers, merchants, financial institutions, businesses, strategic partners and government entities through innovative technologies. Sharing the same vision in terms of financial inclusion, the two entities have signed this partnership for the continuity of financial education on a large scale in DR...

Read MoreThe FPM participated for the 5th year in a row on March 25th to the Global Money Week (GMW). For the occasion a forum and a press conference were held, in Inkisi, in the Province of Central Kongo. The topic of the 11th Edition of the GMW was “Plan your money, plant your future”. This year’s focus was on sustainability and raising awareness of young people on their involvement in financial behavior, not only for their own future, but also for the future of the environment and society. The activity, organized in partnership with VISA, brought together more than 100 school children from Inkisi with whom two expert trainers addressed the following sub-themes in depth: “Planning your future to save better” “The importance of digital financial services for young people” The main objective of the FPM was to enable schoolchildren, future clients of financial institutions, not only to learn how to manage their money, but also to transmit this knowledge to their families and communities. The Global Money Week (GMW) is a world planned event. Initiated since 2012 by the Child and Youth Finance International (CYFI) network, this awareness campaign aims to encourage children and youth to be more financially savvy, to acquire the necessary knowledge, skills and behaviors to make sound financial decisions. In the Democratic Republic of Congo (DRC), this activity has been celebrated since 2015 and is implemented by some local actors (The Central Bank of Congo, the FPM, Financial Sector Professional Associations, some financial institutions, NGOs, etc.). Children and youth make up the largest portion of the population in the DRC, which justifies that special attention be given to them through financial education activities, enabling them to become economically equipped and empowered citizens and ultimately reduce...

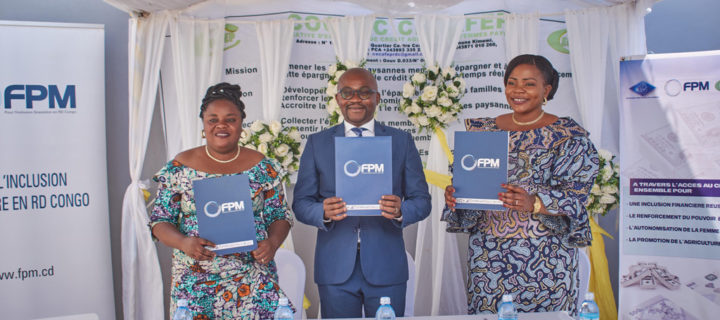

Read MoreThe financial company FPM SA represented by its Deputy General Manager, Mr. Patrick NKONGO MAMBU signed a financing agreement on Friday May 13, 2002, with the Cooperative of Agricultural Savings and Credit of Women Farmers (CECAFEP) represented by the Chairperson of the Board of Directors, Ms. Vasimire TSIKO Stella and the Manager, Ms. Baraka KYAVEREKI BLESSING. The official ceremony took place at the headquarters of CECAFEP in Butembo in the province of North Kivu. Concerned about its mission to support the construction and development of an inclusive, solid and responsible financial system through the refinancing of financial institutions that target SMEs and low-income people, FPM SA granted financial support to the COOPEC CECACEP to strengthen the financing of agricultural and peasant women in its areas of intervention, in the territories of Lubero and Béni. Indeed, women farmers actively contribute to economic development by maintaining agricultural activity in an area where the climate and soil fertility offer opportunities for several agricultural crops. This is notwithstanding the many difficulties faced by economic operators in this province of the DRC. The resilience shown by the microfinance institution CECAFEP, which operates in areas facing various security challenges, contributes to improving the level of financial inclusion of women farmers in these areas, the main targets of the COOPEC, and other members who wish to join the COOPEC. The funding granted by the FPM SA in the medium term has the primary objective of contributing to the empowerment of peasant women through access to credit and to the training offered by CECAFEP through its network of peasant organizations that are members of LOFEPACO. It also serves to increase the COOPEC’s loan portfolio with a longer maturity, which is necessary to improve the repayment capacity of women farmers whose loan repayment is still linked to the cultural...

Read MoreThe FPM SA and the Microfinance Company TID SA have proceeded this Saturday, May 14, 2022 to the signing of a medium-term financing contract whose objective is to support the financing of micro, small and medium enterprises in the areas of intervention of TID, namely: Butembo, Beni and Bunia. On this occasion, the FPM SA was represented by its Deputy Managing Director, Mr. Patrick NKONGO MAMBU and the Microfinance Company TID SA, by its Managing Director, Mr. Alfred KAMATE SIVIRI. The Multi-Donor Fund, MPF SA is an initiative of KfW (German Development Bank), BIO (Belgian Investment Company for Developing Countries), Cordaid and Incofin CVSO whose mission is to support the construction and development of an inclusive, sound and responsible financial system in the DRC by promoting access to refinancing for financial institutions that target MSMEs and low-income people. To date, FPM SA supports nearly 15 financial institutions in the microfinance and banking sectors in the Democratic Republic of Congo. TID SA, created in 2013, is the result of the will of a group of local merchants and entrepreneurs who wanted to provide this part of the country with a viable financial institution after the bankruptcy and forced dissolution of certain microfinance institutions during that period. Since the launch of its activities, TID has been operating in areas facing multiple security challenges where it contributes to improving access to financial products and services for the population. In addition to financial products such as savings, credit and transfers, TID’s product range includes training and coaching for its clients. Thus, the senior debt financing concluded today aims to strengthen TID’s medium-term financing capacity to support clients in its areas of intervention where commercial activity remains intense and agricultural potential allows the exploitation of certain crops that require medium- and long-term...

Read MoreThe FPM ASBL represented by its General Manager, Mr. Jean-Claude THETIKA signed, on Monday 21 March 2022 in Kinshasa, the sixth technical assistance contract with the MFI HEKIMA, represented by its General Manager Mr. Laurent Daddy YAMBA MENAYAME. The MPF is an actor that contributes to the emergence of a sustainable offer of quality financial services in favour of micro, small and medium enterprises (MSMEs) as well as low-income people. By signing this technical assistance partnership, the FPM ASBL and the MFI HEKIMA have decided to continue their joint contribution to the provision of better financial services for MSMEs and low-income people in the DRC, which is a strategic sector for the country’s development. The MPF was created in 2007 as the micro component of the Microfinance Sector Support Programme (PASMIF). It has been providing technical assistance to the Congolese financial sector since November 2010 in the form of a non-profit association (ASBL) under Congolese law, thanks to funding from its donors: the German Financial Cooperation (KfW), the French Development Agency (AFD), the World Bank and the UNDP/UNCDF. Created in 2003 by World Relief, with the financial support of USAID, the MFI HEKIMA is a microfinance institution working in the regions of Kivu (North and South Kivu). It has undergone two institutional transformations: in 2007 it became a 2nd category microcredit company (without the possibility of collecting savings), then in 2017 with the support of the FPM ASBL it became a microfinance company that expanded its product offering (including savings). The present partnership aims to initiate the digital transition of the MFI HEKIMA in order to enable it to diversify its product offering and better exploit its growth potential. To this end, the FPM ASBL proposes a 2-year support plan structured around three main areas. These are as follows Area I: Support for the digital transition Axis II: Product diversification Axis III: Support for regional expansion with the operationalisation of a new physical agency in rural...

Read MoreThe African Microfinance Week (SAM) 2021 took place from Monday 18 October to Friday 22 October in Kigali, the capital of Rwanda. The SAM is the largest conference on inclusive finance in Africa. It brings together international inclusive finance professionals every two years in one of the African countries for a conference, training, an investor fair and an innovators’ village. Organised by ADA (Appui au Développement Autonome) with the support of the Luxembourg and Rwandan governments, the SAM is the premier event for inclusive finance in Africa . In addition, participants benefited from over 20 training sessions by experts from microfinance institutions, banks, investment funds, regulators and public institutions. The FPM took an active part in the SAM meeting as a sponsor. Then, through its officials, the MPF intervened in different parallel sessions during the event. At the outset, it should be noted that the MPF is a fund that supports micro, small and medium-sized enterprises (MSMEs) by promoting the construction and development of an inclusive, sound and responsible financial system. The MPF offers technical assistance and refinancing services tailored to financial institutions in DR Congo that serve MSMEs and low-income working populations with real development potential. The FPM was institutionalised in 2010 as a non-profit association (ASBL) under Congolese law with Mr Jean Claude THETIKA as its Managing Director. In 2014, the sister vehicle, the FPM SA, whose general manager is Mr Carlos Kalambay KABANGU, was created to also ensure the refinancing of financial institutions in DR Congo. The two entities are now complementary: FPM ASBL provides technical assistance to financial institutions offering financial products and services to MSMEs, and FPM SA is dedicated to refinancing financial institutions. Speaking at one of the sessions, Mister. Jean Claude THETIKA, in his capacity as a general manager of the FPM ASBL, spoke about the adjustment of the cooperative model to local realities and the role of cooperatives in strengthening the resilience of members, given the challenges of governance and economic imperatives in DR Congo. For his part, Mister. Carlos KALAMBAY KABANGU, general manager of FPM SA, spoke about access to refinancing, which is a factor in strengthening the resilience of the microfinance sector in the face of...

Read More