Intervention approach

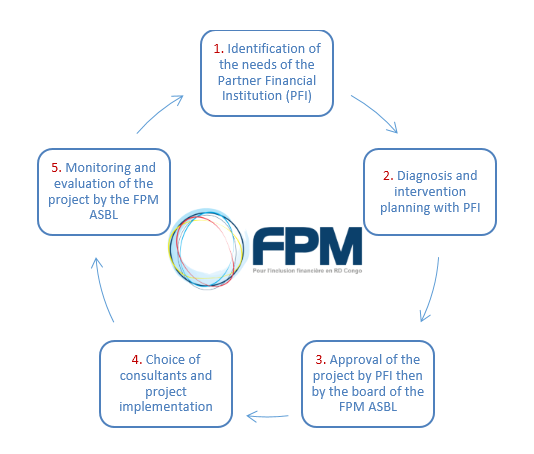

FPM ASBL responds to specific requests from partner financial institutions. It also identifies, in consultation with partner financial institutions, their capacity building needs. Once these have been identified, FPM formulates an intervention plan, which is discussed with the partner financial institution. After approval by the partner financial institution, the project is submitted to the Board of Directors of FPM ASBL. After validation, FPM ASBL and the partner financial institution sign an agreement and implementation can begin. Below the project management cycle of FPM ASBL with its partners is being described:

(PFIs: partner financial institutions)

To ensure successful implementation and a positive impact of long-term interventions, FPM respects three fundamental principles:

- Technical assistance interventions must be tailored, targeted and effective. Projects of FPM ASBL are limited in time and implemented according to the best project management standards.

- Achieving sustainable results: FPM seeks an impact of its interventions over the long term. It ensures that partner financial institutions gain greater autonomy and encourages them to integrate fully into the private sector.

- Mandatory co-financing of PFIs: the implementation of a direct technical assistance project is subject to co-financing which varies according to the size and financial capacity of each PFI.