Our projects

FPM ASBL serves a variety of financial institutions

FPM ASBL managed 131 projects between January 2011 and December 2017, of which 46 direct technical assistance projects for 23 PFIs and 85 transversal technical assistance projects, of which 46 training sessions, 26 forums and 13 market studies.

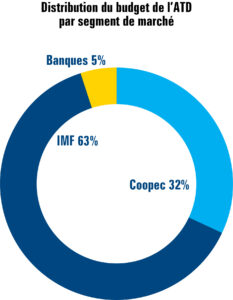

By the end of 2023, savings and credit cooperatives had received almost 32% of the total resources allocated to direct technical assistance, microfinance institutions 63% and commercial banks targeting MSMEs 5%.

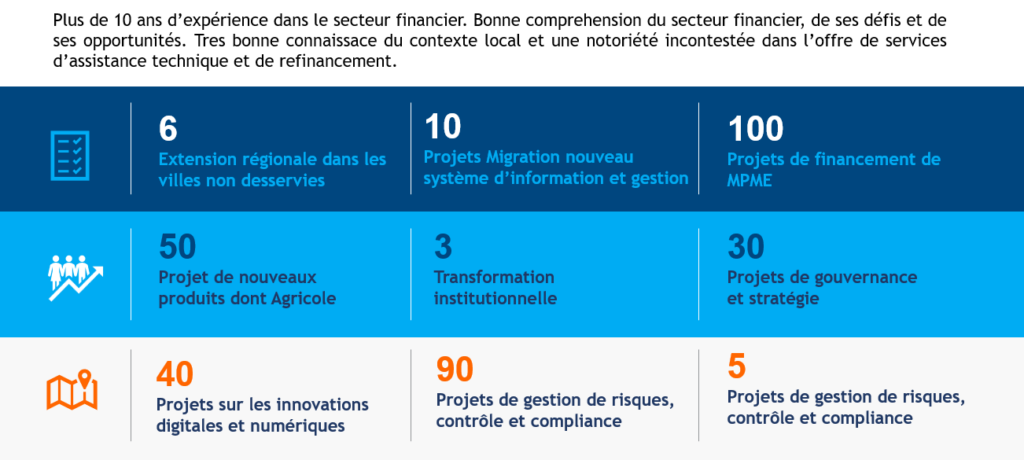

Our achievements: some key figur

Our achievements: some of the partners who have placed their trust in us

IMPACT OF FPM ASBL: contributing to greater and more responsible financial inclusion